The Zakat, Tax and Customs Authority (ZATCA) in Saudi Arabia has introduced the APA mechanism by virtue of its Transfer Pricing Bylaws and the APA Guidelines. In Part I of the APA Series, we discussed the key features of the APA mechanism. Here, we elaborate the APA application process with practical insights and challenges faced during the application process.

The APA Procedure

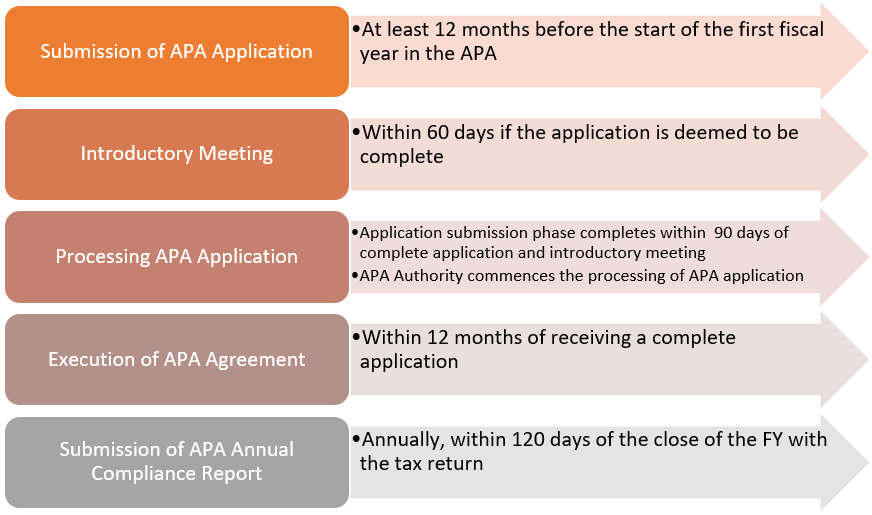

The APA process is structured into distinct stages as depicted below.

1. Submission of APA Application

Pre-file Meeting

ZATCA’s APA Guidelines provide an option to the Tax/Zakat payer to request a pre-file meeting with the APA team before formally submitting an application.

Here, it is important to note that the request for a pre-file meeting cannot be made on an anonymous basis. It must provide the details of the Tax/Zakat payer and the relevant transaction.

Drafting the APA Application

The APA application and all documents must be either in Arabic or in English.

Drafting the APA application is one of the most crucial aspects of the entire process. The application must be comprehensive to cover the details of the transaction and the relevant parties. At the same time, it must be lucid and self-explanatory for the APA officers to understand and evaluate the possibility of executing an APA agreement.

More specifically, the application must be comprehensive to inter alia cover the following aspects:

- nature of the transactions (eg. goods or services supplied, common sharing of expenses etc.), executed agreements between the parties, consideration etc.;

- zakat/tax year(s) for which the APA is sought;

- involved parties – their particulars viz. the legal and tax residence status, organization structure, nature of business, key managerial personnel, relation between the parties and so on;

- the proposed Transfer Pricing Method (TPM) – this involves a FAR analysis of the Covered Transactions and the relevant parties, identifying comparables and arriving at an appropriate TPM with justification for ruling out the other methods.

Submission of the APA Application

An APA application must be submitted electronically via the Electronic Registration System (ERAD) portal. However, APA applications for complex transactions (i.e., transactions below the threshold limit of SAR 100 million) can be submitted through an assigned relationship manager or by contacting the APA team via ZATCA’s official communication channels.

It is crucial that the application is submitted at least 12 months before the start of the first fiscal year specified in the agreement. Failure to submit a complete application by this deadline will result in automatic rejection through the e-portal, requiring the Tax/Zakat payer to adjust the effective starting year to proceed. For instance, if the Tax/Zakat payer seeks an APA application for tax years 2027, 2028, and 2029, the APA application must be made at least before 31 December 2025.

We believe there is some room for flexibility here. ZATCA may consider introducing rollback provisions to align with global practices, i.e., an APA application may be made for previous tax years too. Further, in light of the dynamic business models, the time limit of 12 months can be reduced.

Completed Application

ZATCA will acknowledge receipt and assess the application for completeness. If the application is incomplete, ZATCA may call for further information or documents.

2. Introductory Meeting

An introductory meeting is scheduled only after the application is deemed complete, typically within 60 days of its submission. The meeting takes place between the APA Authority and the Tax/Zakat payer, usually represented by their advisors.

This meeting allows the Tax/Zakat payer to present their business operations, organization structure and activities, with a focus on Covered Transactions and the proposed TPM. ZATCA uses this opportunity to ask clarifying questions about the Tax/Zakat payer’s past, current, and proposed future zakat/tax filing positions. Apart from the above, the key topics include:

- Description of Related Persons and Controlled Transactions

- Overview of functional and risk profiles

- Discussion on benchmark study and expected periodic scope

- Proposal for the TPM and key critical assumptions

- The APA Period (maximum of three years)

- Extent of required information and documentation

- Expected compliance requirements post-agreement

The introductory meeting serves as an excellent opportunity for the Tax/Zakat payer and their advisors to make their case before the APA Authorities. For instance, transactions involving a nexus to tax havens are often evaluated with a pinch of salt. This meeting serves as an opportunity to convince the APA Authority to consider the application based on it genuineness rather than the fact that it involves a tax haven country.

While routine matters are discussed, ZATCA does not make commitments at this stage but may request further information to evaluate the APA Request’s suitability.

3. Processing the APA Application

APA Request Processing (Preliminary Evaluation)

Following the submission of a complete application and the introductory meeting, the Tax/Zakat payer is informed of the preliminary evaluation outcome regarding the APA request. The submission phase is expected to conclude within 90 days of making the application.

Application Review and Analysis

ZATCA conducts a thorough review and evaluation of the APA application to ensure the proposed APA achieves arm’s length results for the Covered Transactions, is sufficiently supported by information, and aligns with facts and introductory meeting outcomes.

During this phase, ZATCA may conduct site visits and functional interviews to gain a deeper understanding of the business and industry, clarify issues, and gather additional information. Site visits help verify the provided information, while functional interviews clarify business activities of the Tax/Zakat payer and Related Persons.

At any stage in the APA application, ZATCA may send follow-up questions and request additional information, with reasonable deadlines set for submission. Tax/Zakat payers’ proactiveness in providing the required information in a timely manner serves as an important factor in expediting the execution of the APA agreement. Contrarily, failure to provide requested information can lead to delay / discontinuation of the process.

Negotiation of the APA

After review and evaluation, ZATCA will discuss its position and findings with the Tax/Zakat payer through a negotiation process. Once a consensus is reached, ZATCA drafts the APA and related documents for the Tax/Zakat payer’s approval.

4. Executing the APA Agreement

Execution

The APA is concluded and formally signed by authorized representatives of both, the Tax/Zakat payer and ZATCA, once all terms and conditions are confirmed and agreed upon.

The time taken to finalize an APA depends on Tax/Zakat payer cooperation, case complexity, and the completeness of provided information. ZATCA aims to finalize its position within 12 months of receiving a complete application. As per OECD’s 2023 Advance Pricing Arrangement Statistics, the average time taken to grant APAs globally was around 36 months in 2023. In light of these statistics, ZATCA’s targeted time period of 12 months seems to be optimistic.

Impact on Other Remedies

It is important to note that executing an APA does not preclude ZATCA as well as the Tax/Zakat payer from pursuing other remedies under the tax law. Thus, ZATCA can conduct conducting transfer pricing audits and make adjustments for Covered Transactions for the relevant Tax Years.

Conclusion

The APA process in Saudi Arabia is a structured and collaborative mechanism that offers certainty and transparency in transfer pricing matters. While it demands detailed documentation, proactive engagement, and continuous communication, it also presents Tax/Zakat payers with an opportunity to resolve complex TP issues in advance. ZATCA’s clear timelines and openness to discussion are welcome.

In Part III of this APA Series, we will explore the possible outcomes of an APA and the options available to Tax/Zakat payers post-agreement.

Author

Gopal Agarwal

Director