Global Recognition for APAs

In recent years, Advance Pricing Agreements (APAs) are witnessing increased action and attention globally. It is an established transfer pricing alternate dispute resolution mechanism across many nations. The OECD1 releases APA statistics periodically and announces APA awards to tax authorities in recognition of efforts by competent authorities.

While the principles and jurisprudence around APAs are well-developed in various countries, the APA mechanism in the Middle East region is still in nascent stage post introduction into its tax laws. The UAE has introduced the APA mechanism in its corporate law. Likewise, the Zakat, Tax and Customs Authority (ZATCA) in Saudi Arabia had also introduced the APA mechanism for its Tax/Zakat payers by virtue of its amendment to KSA TP Bylaws by Zakat, Tax and Customs Authority pursuant to Board Resolution No. (8-2-23) dated (28/08/1444H) corresponding to 20/03/2023 A.D. and the APA Guidelines.

APAs provide tax certainty – to the Tax/Zakat payers as well the ZATCA. They reduce the risk of prolonged audits and disputes and offer clarity on transfer pricing methods for both domestic and cross-border controlled transactions. They help Tax/Zakat payers to forecast their Tax and/or Zakat liabilities. Overall, they offer a proactive approach to managing transfer pricing risks allowing efficient utilization of time and manpower resources for the purpose of core business activities.

Below we discuss the overview and broad understanding of the APA regime made effective from 1 January 2024 by ZATCA for the Tax/Zakat payers followed by the detailed nuances of the APA regime in our Part II of the APA series.

Understanding APAs

As the name suggests, an APA is an advance pricing agreement between the ZATCA and a Tax/Zakat payer. Both the parties agree to a certain transfer price for a specific transaction/(s) between the Tax/Zakat payer and Related Persons. APAs confirm the appropriate transfer pricing methods that will be used to determine the arm’s length price in advance.

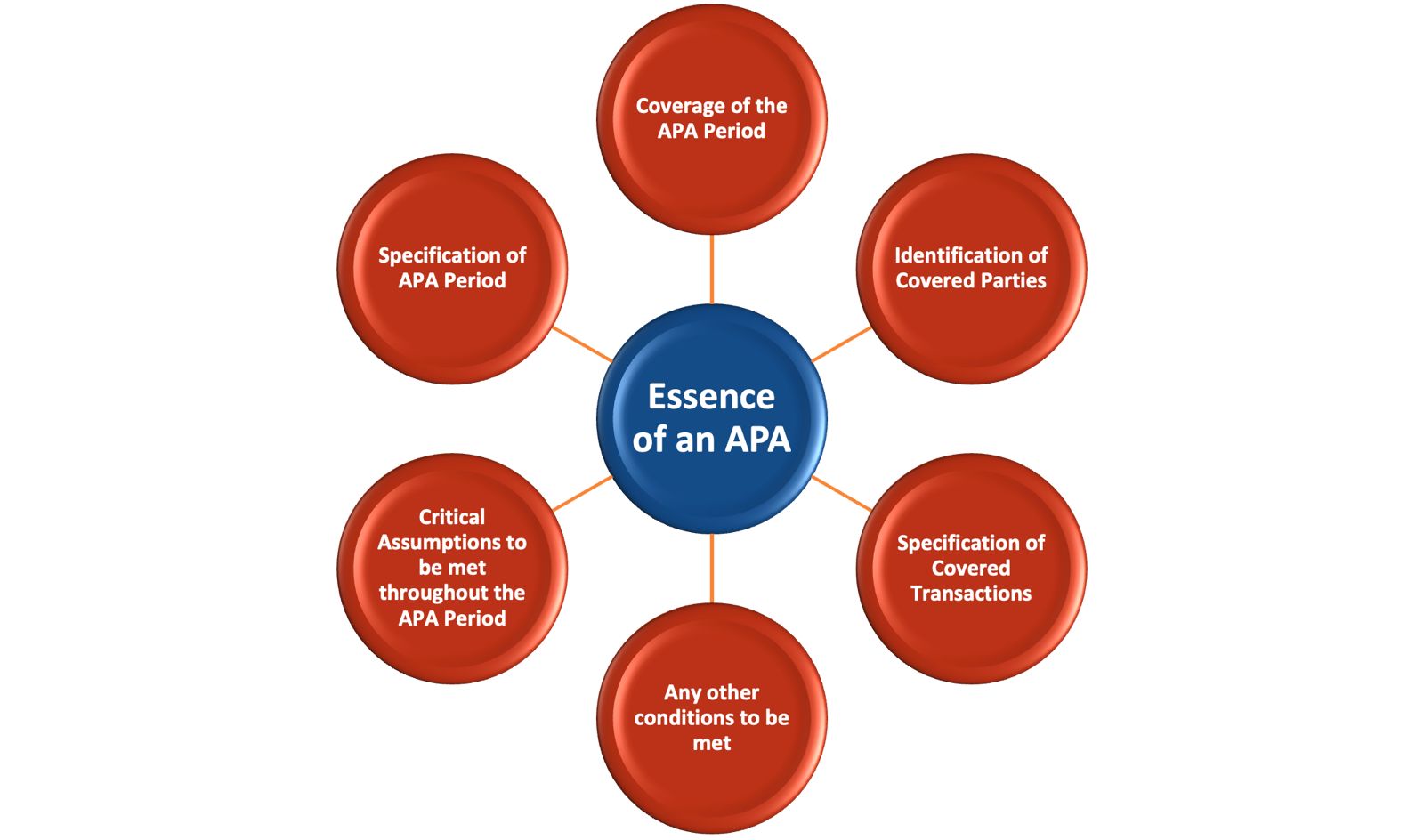

The graphical representation below summarizes the essence of any APA.

Generally, there are 3 types of APAs – Unilateral APA, Bilateral APA (BAPA) and Multilateral APA (MAPA) as explained in the table below. Globally, bilateral and multilateral APAs are also in practice. Considering that the APA procedures are still at a nascent stage in the Kingdom, ZATCA has introduced provisions for unilateral APAs only. Here, it would be interesting for Tax/Zakat payers in the Kingdom to explore the implications of a bilateral or multilateral APA initiated by a Related Person in a foreign jurisdiction.

| Type of APA | Parties involved | Features |

|---|---|---|

| Unilateral APA | Agreement between a taxpayer and ZATCA | Covers only Saudi Arabia; no input from foreign tax authorities |

| Bilateral APA | Agreement involving ZATCA and a foreign tax authority with whom KSA has a tax treaty | Ensures consistent transfer pricing treatment in both countries |

| Multilateral APA | Agreement involving ZATCA and multiple foreign tax authorities with whom KSA has a tax treaty | Useful for complex transactions involving several jurisdictions |

Key features of APAs in Saudi Arabia:

- Scope and Applicability

An APA application can be made if each2 covered transaction exceeds the threshold limit of SAR 100 million in a Zakat/Tax Period. It can also be made for some complex transactions below the threshold limit that involve challenges in determining an appropriate transfer price due to the nature of the transaction, inability to determine the most appropriate transfer pricing method or unavailability of comparables. APA applications for profit attribution to Permanent Establishment are outside the purview of ZATCA’s APA Guidelines. - Taxes covered

An APA application can be made with respect to Zakat and/or Tax payable in the Kingdom - Period of application

The APA period is typically 3 years with prospective application. Rollback provisions (i.e., application of APA for past years) is not yet introduced by the ZATCA. The APA can also be renewed for another 3 years. - Binding nature

An APA is binding on the parties covered, i.e., the Tax/Zakat payer and the ZATCA for the Covered Transactions and the APA Period. It holds an important position at the time of litigation. - Validity of APA

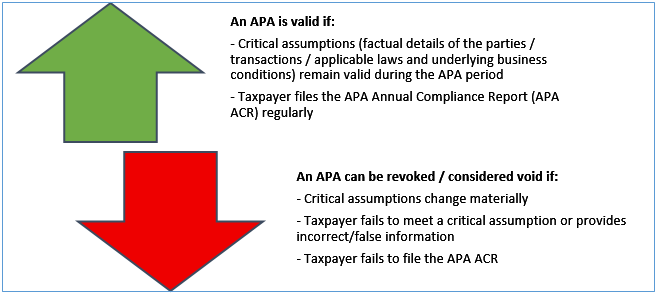

Like any other agreement between the contracting parties, the APA remains valid if the terms, conditions and assumptions governing the same are adhered to by the parties, especially the Tax/Zakat payer in case of an APA. The following graph gives a glimpse of cases where an APA can be considered valid and can be revoked.

Procedure and Compliance

Generally, the Tax/Zakat payer makes an APA application electronically in consultation with its tax advisors. The application3 must be submitted at least 12 months before the start of the Tax Period for which it is sought. It must cover all the relevant details to make a case for the need of an APA. ZATCA gives an opportunity to the Tax/Zakat payer / its advisors, by way of an introductory meeting, to present the details of the Transaction, parties etc. This meeting is expected to be scheduled within 60 days of the filing of the formal application request and is an important element in the process of the APA application.

An executed APA may include a provision allowing the Tax/Zakat payer to make compensating adjustments. These adjustments align the Tax/Zakat payer’s financial statements and return of covered transactions with the amounts or results determined by the APAs.

Generally, the APA is expected to be signed and executed within 12 months of making a valid application.

Tax/Zakat payers must submit an APA Annual Compliance Report (APA ACR) for each year covered by the APA, within 120 days end of each Tax Period, along with the Tax/Zakat return. The report must include all required financial and analytical details. Non-compliance may lead to cancellation of the APA.

Conclusion

The APA mechanism is a discretionary service provided by ZATCA to attain tax certainty in the Kingdom. There is no legal obligation or entitlement to request an APA for Tax/Zakat payers. In other words, making an APA application is not mandatory, but it is certainly advisable for complex transactions.

Transactions involving payment of royalties for intellectual property, intra-group services or sharing common resources, supply of composite services, installation of turnkey infrastructure projects are some examples where comparables may not be easily available and it becomes imperative to explore the APA route for crystalizing tax liability. Besides, some risk-averse Tax/Zakat payers may also wish to make an APA application for other normal business transactions like supplies of goods and services between Related Persons.

While this article provides the overview and broad understanding of the APA regime in the Kingdom; In Part II of this APA Series, we will discuss the nuances of an APA process in Saudi Arabia.

2 In cases of multiple transactions that are closely linked, as outlined in paragraph 4.4.2. of the latest edition of the Transfer Pricing Guidelines, such transactions may be aggregated and treated as a single transaction to meet the threshold requirement.

3 See Unilateral APA application – Appendix 1 of the APA Guidelines

Author

Gopal Agarwal

Director