Executive Summary

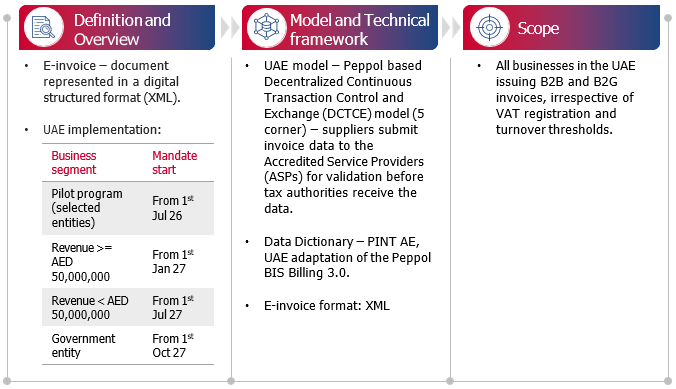

The UAE Ministry of Finance has introduced a new Electronic Invoicing System through Ministerial Decisions No 243 and No 244 of 2025, making a significant advancement in the country’s financial infrastructure. The system excludes certain transactions, such as those by government entities in a sovereign capacity and specific international transport services, from its scope. The phased implementation will start with large businesses by January 2027, followed by smaller businesses and government entities, with a pilot program beginning in July 2026. Additionally, businesses can voluntarily adopt eInvoicing starting July 2026, promoting efficiency and transparency in business transactions across the UAE.

Key highlights

1. Ministerial Decision 243 of 2025 on Electronic Invoicing System:

- Business Transactions to be excluded

- Transactions by Government entities in a sovereign capacity, not competing with the private sector.

- International passenger transport services by airlines, where electronic tickets are issued.

- Ancillary services provided directly to passengers by airlines with electronic miscellaneous documents.

- International goods transport services by airlines, excluded only for 24 months from the date on which the Electronic Invoicing system becomes effective.

- Financial Services exempt from VAT or at Zero rated (Art 42 of the VAT Executive Regulation)

Our Comments: Financial Services was a particularly noteworthy exclusion, as it would have otherwise represented a challenging obligation.

- Exchange and Reporting Obligations

- Businesses are required to transmit electronic invoices and credit notes, within 14 days of the transaction date. Which is defined in the Ministerial Decision as the earlier of the date on which the Business transaction occurred or the date of receipt of payment.

- If the issuer is registered for VAT, they must issue and send the electronic invoice and Credit notes to the recipient within the timeline specified in the VAT Law.

- The issuer must issue and send the Electronic Credit Note to the Recipient in the following situations:

- If the transaction is cancelled

- If the agreed payment for the transaction has been reduced

- Refunds

- Administrative or numerical error

Our Comments: Based on the released Ministerial Decisions, it appears that electronic invoices and credit notes issued by VAT registered entities must be generated within 14 days as per timeline prescribed in the UAE VAT legislation. In contrast, unregistered entities must issue electronic invoices and credit notes within the 14 days of the business transaction date.

- Businesses Obligations

- Entities must appoint accredited service provider for compliance with the Electronic Invoicing System.

- Data must be stored within UAE, following the timeline specified by the Tax Procedures Law.

- Businesses must notify the Authority of a System Failure within 2 business days of its occurrence.

2. Ministerial Decision 244 of 2025 Implementation of the Electronic Invoicing System:

Phased Implementation Rollout

The implementation of electronic invoicing in the UAE will occur in phases, determined by the revenue threshold and taxpayer category, as follows:

| Taxpayer Category by Revenue | Deadline to appoint a Service Provider | Implementation deadline |

| Large Businesses with revenue more AED 50M | 31 July 2026 | 1 Jan 2027 |

| Businesses with revenue less than AED 50M | 31 March 2026 | 1 July 2027 |

| Government Entities | 31 March 2027 | 1 October 2027 |

The revenue refers to the gross income earned during the most recent accounting period, based on the Financial Statements.

Our Comments: This captures the most notable elements of the announcement. While we initially anticipated a mandatory go-live from July 2026, the additional six-months for larger businesses is a welcome adjustment.

The phased rollout now provides clarity on the number of implementation waves, with the remaining non-governmental taxpayer base expected to comply by 1 July 2027. This means the UAE will experience a period of intense activity throughout 2026 and early 2027. Fortunately, the relatively short overlap between traditional invoicing and eInvoicing operations should help ease the transition and reduce complexity overall.

Pilot Programme

The Pilot Programme begins on 1 July 2026

Voluntary Implementation

Starting from 1 July 2026, any business may choose to voluntarily implement eInvoicing.

Summary: UAE eInvoicing model