Dhruva Consultants Story

Dhruva Consultants is a part of Dhruva Advisors LLP, a boutique tax and regulatory services organization. At Dhruva we work closely with regulators on policy issues and with our clients on tax advocacy and advisory matters. Dhruva Advisors LLP is headquartered in Mumbai-India, with 10 offices pan-India and globally, including Dubai, Abu Dhabi and Singapore. Globally, we are a team of approximately 315 Tax Professionals comprising of Chartered Accountants and Tax Attorneys, led by 19 Partners. Over 50 of these key Tax Specialists are based in the GCC region itself. We are a member firm of W T S Global, a network of selected tax and specialist regulatory organizations that operates in more than 100 countries. Dhruva Worldwide and WTS Global members have won various global accolades, including both European Tax Awards and Asia Tax Awards.

Dhruva Consultants Offices

Learn more about Dhruva World Wide offices:

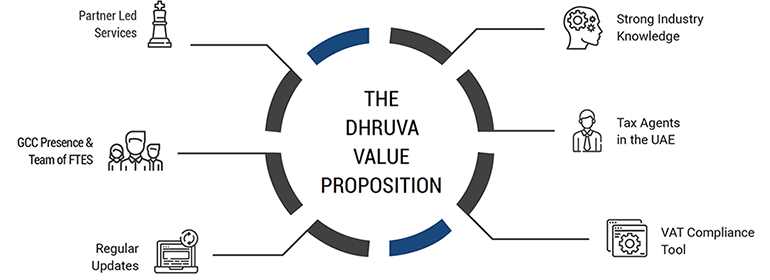

Dhruva Consultants Value Proposition

Our value proposition reflects our work ethic which is deeply rooted in our conviction to make a difference to your business, irrespective of its nature, size or geography.

What Makes Us Unique

Key differentiators:

- Partner driven services

- Proactive ideation to mitigate risk in an increasingly VUCA environment

- Strategic approach to complex problems

- In-depth, specialised, robust and knowledge centric advice

- Strong track record of designing and implementing pioneering solutions

- Trailblazers in tax controversy management

- Long history of involvement in policy and advocacy

Our Clients

We work with clients across industries and sectors, providing value-based solutions to their business problems through our team of subject matter experts who bring insight to the forefront.

Retail

UAE is a hub of several eminent and prestigious global brands finding their space in the world-class malls or available ‘on-the-click’ through e-commerce. From the glittering world of fashion and apparel to the innovative world of electronic products bringing the change in our life, we have advised the diversified family groups and multinational companies having presence in the retail segment on a range of VAT matters, including advising on complex arrangement that are typical of retail sector.

Real Estate & Construction

UAE is one of the largest construction markets in the GCC region and is expected to grow with the prospect of Dubai Expo 2020 and beyond. There are various projects at different stages of completion across UAE in line with country’s economic diversification goals in the areas of transportation, education, etc. We have been advising top tier construction companies as well as pioneer and largest master developers on VAT issues relevant to their sector.

Hospitality

UAE is the regional hub for leisure travelers as well as business persons for meetings, conventions, exhibitions, etc. There has been a tremendous growth in terms of people visiting UAE year-on-year due to significant new tourist attractions, traditional Arab hospitality, highly developed infrastructure and many other reasons. We have the experience of working with leading luxury and business hospitality chains and assisting them with VAT, Excise and the other unique tax challenges of the industry.

Transport & Logistics

UAE is fortunate to have a strategic location between the east and the west coupled with strong offerings by the free zones, massive investment in the transport sector, state of the art infrastructure and with ease of doing business in UAE the Logistic sector has bloomed in UAE. We have unparalleled exposure in addressing both customs and VAT complexities for integrated shipping and logistics service providers by being associated with world-class logistics and associated services provider.

Healthcare

With over 200 nationalities in UAE, providing world-class healthcare services is one of the six pillars of the National Agenda of UAE, which is also in line with its “Vision 2021” plan. The National Agenda emphasizes on preventive medicine and efforts to reduce and cancer and lifestyle related diseases. We advise some of the largest healthcare providers and regulators in the UAE on tax matters related to this sector which is critical to the UAE economy.

Case Studies

Our ethos is to provide quality deliverables to our clients, with maximum partner face time, and ensuring quick turnaround to client queries. A synopsis of client work that we are proud of is as follows:

Awards & Accolades

| DHRUVA AWARDS | WTS GLOBAL AWARDS |

|---|---|

|

|

- Dhruva Advisors has been consistently recognised as a Tier 1 Firm for Tax, Transfer Pricing & Indirect Tax by ITR.

- WTS Global has been recognised as a Top Ranked Firm by Global Chambers and Partners